Uber says it's not worried about new competition in its biggest market in Europe

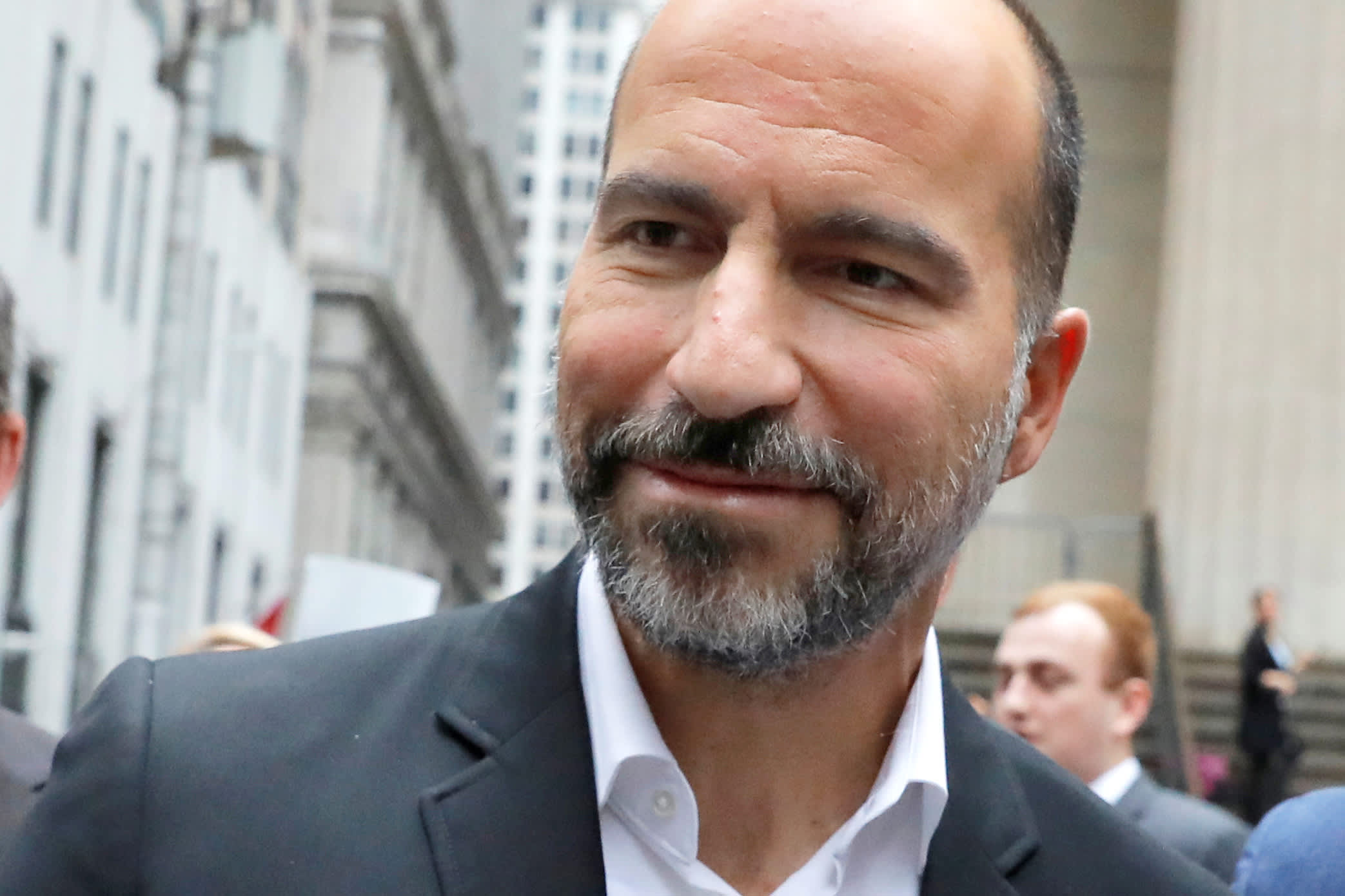

Uber Technologies CEO Dara Khosrowshahi outside the New York Stock Exchange ahead of the company's IPO, May 10, 2019.

Uber is facing growing competition in London in ride-hailing and food delivery, from scrappy start-ups to the deep pockets of Amazon.

But Uber CEO Dara Khosrowshahi says he's not worried about new players entering the crucial European market.

"The new competition that we're seeing in London are frankly competitors that we're familiar with," Khosrowshahi said on the company's second-quarter earnings call Thursday. "So far we're not seeing anything in London that's a surprise or unexpected that we're not seeing in, you know, 20 other cities around the world."

Despite ongoing regulatory threats, including its license temporarily being revoked and extended, Uber has remained the dominant ride-hailing platform in London since it launched in the city in 2012. The city is a key market for Uber, home to 3.5 million of its users and about 45,000 of its drivers. Other start-ups are now making a push to steal market share from the U.S. tech giant in the U.K.'s capital.

London competition piling up

Ola, Uber's Indian rival, reportedly received its London license and is expected to launch in the city this fall. French start-up Kapten also started offering its ride-hailing services in the city earlier this year.

"Uber is now the problem of its own making because it's become the price-setter and everybody is now undercutting it from a price-setting point of view," Michael Browne, portfolio manager at investment firm Martin Currie, told CNBC's "Squawk Box Europe" Friday.

Even with the new challengers, Uber remained the most-downloaded ride-sharing and taxi app in the U.K. in the second quarter, according to analytics firm App Annie. Khosrowshahi said the company's addition of public transit services in the app, including live timetables for tube and bus schedules, helped generate "higher engagement," specifically in London.

Food delivery fight

Uber's stronghold in the food delivery space in London appears less firm. This week, Britain's Just Eat agreed to merge with Amsterdam-based Takeaway.com in a deal that would create the biggest food delivery company outside of China. In May, Amazon led a $575 million investment in British start-up Deliveroo, though the investment is facing scrutiny from Britain's competition watchdog.

In a call with CNBC's Deirdre Bosa Thursday, Khosrowshahi said he doesn't expect the Eats business to be profitable "in the next year or year after frankly." Uber reported a net loss of $5.24 billion in the second quarter and also missed revenue estimates. Shares tumbled around 7% in premarket trade Friday morning.

Read More

No comments